Recessions are tough times even for veteran businessmen and women. So how does the younger/upstart entrepreneur handle business challenges in a recession?

Recessions are tough times even for veteran businessmen and women. So how does the younger/upstart entrepreneur handle business challenges in a recession?

Unfortunately or fortunately, recession is a part of ‘business cycles’. They will therefore likely occur a few more times in your lifetime. So it is very important to understand them and know what needs to be done when they do occur.

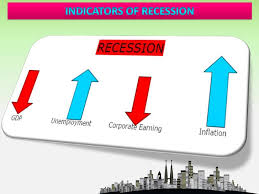

Recession: A recession is defined as ‘a massive slowdown in economic activities’ resulting in a contraction in the GDP for six months (two consecutive quarters) or longer.

Recession: A recession is defined as ‘a massive slowdown in economic activities’ resulting in a contraction in the GDP for six months (two consecutive quarters) or longer.

Inflation is the major culprit cause of recessions as it reduces the quantity of quantity of goods that can be purchased with the same amount of money. Other factors include high interest rates (which can limit liquidity); reduction in real wages (as wages fail to keep with up with inflation); reduced consumer confidence (which inhibits their spending) etc.

The immediate and cyclical consequences of recessions are a reduction in spending resulting in diminished industrial production and retail sales, stagnant wages, reduced corporate profits and real estate prices, and increased unemployment.

Typically, the authorities try to tackle recessions by loosening monetary policies such as reduction in interest rates, increased government spending, reduction in taxation etc.

Recessions affects small/medium businesses slightly differently from large businesses. Our focus here will be largely on the effects of recessions on small and medium businesses and what the entrepreneur needs to do.

The first thing the entrepreneur needs to have is the right mindset necessary to have a clear understanding of the situation. Secondly, the entrepreneur will need to take wise actions and promptly too.

Mindset: As an entrepreneur you should realise that recessions tend to last longer than we either want to believe or hope they will. So, you have to prepare for a ‘long run’ approach to ensuring that not only does your business survive (and be strengthened against the next boom), but that you also take the lessons that comes with the challenges.

- Do not wallow in negativity and blame games. Negativity and blame games will only take responsibility away from you. This will reduce your and your teams’ self-confidence. Realise that you can do well in a recession and equally take away lessons that will help you and your business for years to come. You need to be calm, collected and focussed. No matter what, do not kill your enthusiasm.

- Think ahead and beyond the recession. Having a long term perspective during a recessionary period will empower you. Simply appreciating that it wouldn’t last forever, and seeing ahead of the recession, will help you adopt the right mental attitude to handling the immediate challenges and upcoming opportunities.

Strategy, Planning and Execution: Many of the measures that will you will need to take will neither be pleasant nor easy. But the business needs to be saved so that you and the business can come out wiser and stronger.

Your objectives should be to:

- Survive the recession,

- Plan and position your business against the next boom economy (it will come!)

- Internalise the lessons learnt, as they will help you in subsequent recessions (they will come again, too!)

To achieve the above goals you should:

- Deliberately draw up a short-term strategy for surviving the recession,

- Plan for the next boom economy,

- Execute. Execute. And execute!

Drawing up strategies, making plans and execution means you have to study the situation very well, as well as discuss extensively with your staff, customers etc. Based on the results of your study and discussions, you will have to draw up specific, detailed and robust strategy and plans that will help you achieve the above mentioned objectives. There is absolutely no time to waste on this as you don’t have the luxury of time. Some of the specific measures that can help you and your business may include:

- Reorganise: Recessions brings about completely different challenges from boom times. It is important that you look inwards to know what your strengths (in the recession) are and leverage on them. You might be looking at resources, products, markets and services. Ask yourself what positive impacts you can take out of each that will help you out-survive the recession. Similarly look out for and eliminate the dead weights. Quite frequently, unfortunately, jobs might need to be cut. If you have to, do this responsibly, fairly and humanely. Remember there is life after recession!

- Improve efficiency: Sales volumes and cash collections are likely to dwindle during a recession, unless you are successful in taking appropriate measures to forestall against that. Becoming extremely more efficient should therefore be a key objective as well. From production to sales, logistics and administration, look out for areas that will help bolster efficiency. Wastes and frivolous expenses should be identified and eliminated. Look out for wastes in various account classes and eliminate those that will not harm your long term interests. Look out for other classes of expenses that can also be delayed without hurting sales and collections.

- Strengthen relationships: Difficult times have a way of either strengthening or weakening/destroying relationships. Ensure that whilst you remain focused and determined on surviving the recession, you do not take avaidoable actions and measures that will hurt your relationships with your employees, customers and other stakeholders. Whatever tough actions need to be taken should be done dextrously. Most times, people are hurt not so much by what we do but how we do it.

- Manage your cash: As sales dwindle and the risk of bad debts increase, your cash collection rates and quantum of holdings can be threatened. This can ultimately hamper the survival of your business. So it is important to keep complete control on cash inflow and outflow. Avoid spurious spendings that do not result in further sales and collections unless they are long-term investments that will not jeopardise the current survival expediency of the business. Whenever you can, avoid credit sales. A reasonable cash discount might be worth the benefits. Cash is really the king!

- Monitor profitability: Most customers are particularly more price sensitive during a recession, and will try to extend credit periods. They will therefore likely bargain with you to the bones on both. You need to keep your customers at a reasonable, even if lower profits. To do this means you must both control your own costs as well as maintain your profitability. Balancing the need for cash with acceptable profit is delicate in a recession. You need to be clear headed on this.

- Improve customer service: One of the ‘benefits’ of recessions is in helping you further understand the needs of your customers that the good boom times have made you insensitive to! Working with your customers at such times might make it possible for you to add more value and further help them achieve their objectives. Strengthening the bond relationships with your customers during the tough times will help your business in the boom times.

- Think new markets: Boom times have a way of making us complacent. Recession is a period when you have to look out beyond your existing frontiers. It is tough, but look out for and seize any opportunity to sell your existing products to new markets and where possible introduce new products that meet the needs of existing and/or new customers. Maximise the returns you can get from each opportunity.

- Seize opportunities: Recessions offer opportunities to buy assets at a bargain. Look out for the assets that will bolster your performance both in the short-run and beyond the recession and purchase them if you can get a good deal. No matter what you do in such situations though, look after your cash!

- Learn from others: Life is a continuum. We always have people around us with more knowledge, different experiences etc. Discussing with them gives us fresh perspectives and insights that might normally not just occur to us. Discuss with more experienced mentors, associates, juniors etc., and you will be surprised the insight that you might get from them.

- Get support: The ability to seek and get support is a necessary entrepreneurial quality. Governments in particular provide various temporary supports in recessionary times. Check to see if there are such supports in areas that you are in need of, and take good and responsible advantage of them.

- Timeliness of action: No matter how good the your strategies are, unless you execute your plans on time, you will not any result. Not getting results in a recession means ultimately closing down or even going bankrupt. All your plans must therefore have timeliness of execution and responsibility for taking actions duly assigned.

- Internalise you methods: As mentioned earlier, you are very likely to face other recessions in the future. Internalising your experience and successful methods during a current recession will help you. The ‘been there, done that’ knowledge and experience will engender confidence in you and your team when the next recessions knocks on the door!

At the end, how will you know if you were successful in handling the recession?

- If you have gone through it with the right mental attitude, knowing that it was a temporary challenge which also offers opportunities to remove the ‘fat’ and complacency from, and add ‘muscle’ to your business,

- If you strengthened rather than destroy relationships,

- If your business is re-positioned to seize the opportunities in an emerging boom economy,

- If you are happy with what you did.